Market Analysis for 1/14/25

Trade Plan for SPY QQQ

If you are looking to join the Discord (now separate from the newsletter) please see here: JOIN THE DISCORD Please email help@pharmdcapital.com if there are any technical issues. Plans/levels will be posted in the Discord

The new update for the PharmD_KS indicator has now been published. It now has both sections broken out for NQ and also has a wildcard ticker that you can use for anything that we may be trading. See the Link here: PharmD_KS Indicator

The weekly post for SPY 0.00%↑ and QQQ 0.00%↑ should be reviewed prior to this. Link to Market Analysis for The Week Ahead

Be sure you have read the Trading Doggy Style Starter Kit. I will be adding to this over time, likely first focusing on example executions. Trading Doggy Style Starter Kit. A recent update has been made with some additional content.

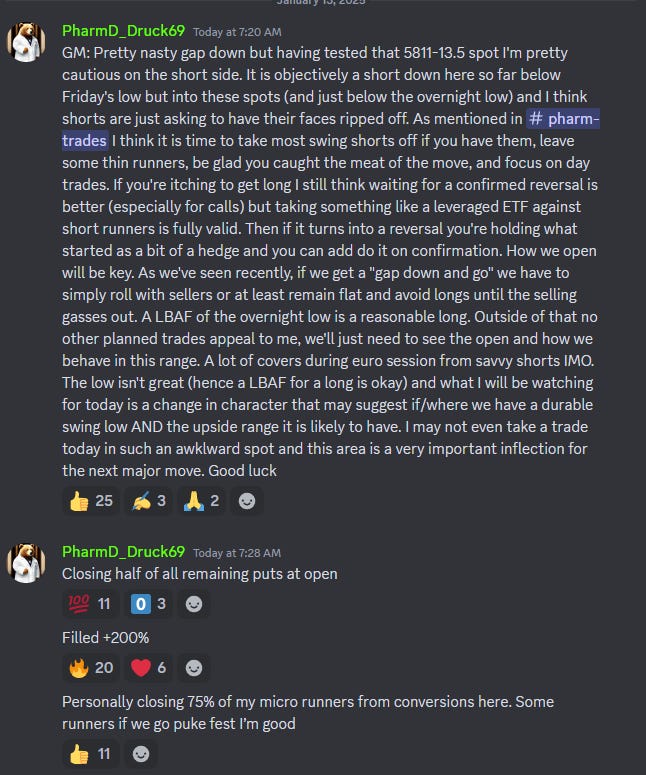

For today we were looking to be short if price got trapped below 5855 (we had a LBAF long as well which was rated quite poorly but worked for +12 early in the session) but increasingly cautious on the short side as we got closer to 5811-5830 and 5811-5813.5 in particular.

The overnight low was 5809 and the cash hours low was 5813. For me, today was just a day to take profit on shorts and then observe the action to evaluate potential for the next move coming out of PPI/CPI this week.

My remaining short position is extremely small and is effectively a hedge as I add a few selective longs. I will below the equity long I am building.

We had been monitoring for this election day gap fill (as has everyone) for quite some time. This response was not unexpected. If I am covering most of my swing shorts and stepping away from the short side near 5811-5813 ES, so are other savvy sellers. So, is this a potential durable swing low for new highs or is it part of another dead cat bounce?