Market Analysis and Trades for 3/28

You Lived a Good Life Bull

If you are looking to join the Discord (now separate from the newsletter) please see here: JOIN THE DISCORD Please email help@pharmdcapital.com if there are any technical issues. Plans/levels will be posted in the Discord so there is no reason to subscribe to both

Note: There will be a price increase on the Discord at the end of the week. As always this will NOT impact anyone already in the Discord (future subscribers only). There will be no change in pricing for the newsletter at this time.

The PharmD_KS Indicator script has now been updated and automatically converts the ES levels to either SPY or SPX per your preference. The link can be found here PharmD_KS Indicator Script V6

The weekly post and for SPY 0.00%↑ and QQQ 0.00%↑ should be reviewed prior to this. Link to Market Analysis for The Week Ahead

SPY 0.00%↑ Today on ES was likely very choppy for many, but for those who like rotational trading both directions it was quite fantastic. Both sides had some excellent setups to choose from.

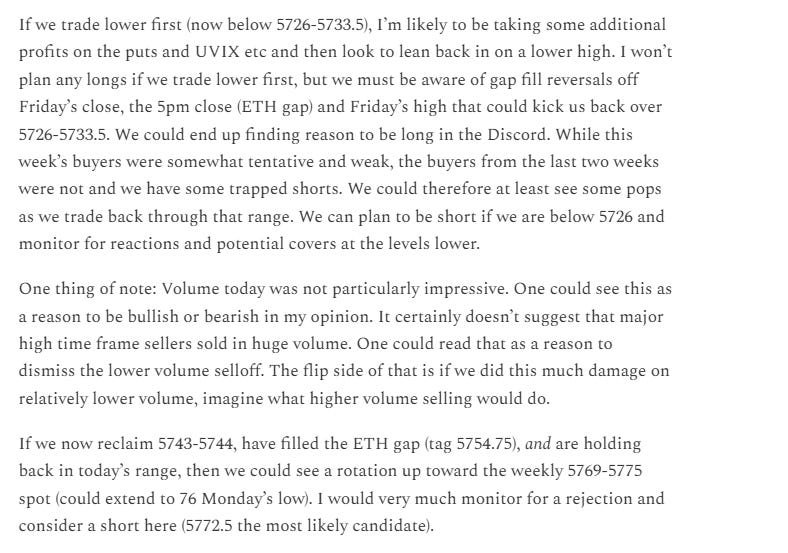

Futures gapped into our major weekly 5726-5733.5 range, held, reclaimed yesterday’s low, filled the ETH gap and proceeded to rotate toward 5769-5775 with the overnight high printing 5772.75 (5772.5 was suggested as the most key level in that range). This provided a fantastic short down to yesterday’s low. Bulls could have taken the long on the way up the first time or taken the higher probability long on the hold of yesterday’s low. This brought price back up to the 69-75 spot and gave another short which ultimately resolved to today’s low of day which was a Friday 5pm close gap fill reversal which offered another long and took out the overnight high. We then saw absorption just above the overnight high with buyers entering at poor location. Once 5771 was lost it offered a nice breakdown short to catch the liquidation. A long at 5748 was offered in the Discord with the IB high as the main target and then the weekly 69-75 spot, which once again offered a nice short back down to the weekly 5726-5733.5 level. Once bulls were able to pressure sellers a bit into the 60s, a fresh back test of 43-48 was offered as a potential long. It would have been preferrable if bulls had tested a bit higher closer to 69, but the 44 hold still resolved in another long up to the weekly 69-75 spot (which again offered a short). All of these were provided ahead of time as I was in and out for the day and was already in my trade for the day but there were plenty of opportunities to trade the edges (my job to define them).

From the plan and Discord (EDT-3):

I believe it is worth noting that today’s high failed the 21ema on ES (non back adjusted) and has crossed down below the 200sma. This has not happened since 2022. I don’t often use moving averages but this pair was extremely key during 2022. It may not be key for this market cycle but it has my attention. Today closed in a perfect doji which makes sense at such a critical location. Bulls need to hold this here for a short time frame higher low and have a significant amount of upside technical damage to repair or this risks making new low of year.

Paid Content Below