Market Analysis and Trades for 3/20

If you are looking to join the Discord (now separate from the newsletter) please see here: JOIN THE DISCORD Please email help@pharmdcapital.com if there are any technical issues. Plans/levels will be posted in the Discord so there is no reason to subscribe to both

The PharmD_KS Indicator script has now been updated and automatically converts the ES levels to either SPY or SPX per your preference. The link can be found here PharmD_KS Indicator Script V6

The weekly post and for SPY 0.00%↑ and QQQ 0.00%↑ should be reviewed prior to this. Link to Market Analysis for The Week Ahead

I have posted an update to AMD for the week. See here: AMD Update

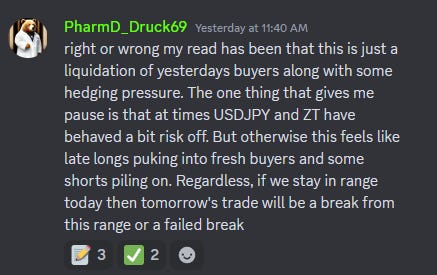

My lean yesterday was that the liquidation of Monday’s buyers was just giving fresh buyers an opportunity to enter. I had monetized some of my hedges at the lows in accordance with this view.

NQ held a critical spot and as mentioned on the Ninja Trader morning show this morning, it gave me a slight bias for higher for today.

AMD 0.00%↑ continues to be my biggest swing and investment holding and it has performed well. It is outperforming both QQQ 0.00%↑ and NVDA 0.00%↑ which is something I was looking for off this swing low. It has been a dog for a long time and has a lot of work to do, so I continue to hedge the highs and monetize the hedges on pullbacks.

While not particularly bearish, I did take a nice short on NQ. I was watching for sellers to step in between 19930-19935 on NQ, drive price down to 19880, and then defend a lower high in the 905-920 range.

We can see the swings went 19937.5→19881.25→19909.75→19769. I was out most of the trade before the rate announcement. It just serves as an example of how one can be reasonably bullish on price but still take a short if the market gives us exactly what we want. It also didn’t hurt to have an intraday hedge against my AMD long in case things went poorly.

We’ve now started to come into some of the stiff tests that we will likely face. Today’s FOMC was quite dovish, so perhaps it will give bulls the strength they need to crack some of these spots.

Paid Content Below