Market Analysis and Trades for 2/13/25

Well Okay Then

If you are looking to join the Discord (now separate from the newsletter) please see here: JOIN THE DISCORD Please email help@pharmdcapital.com if there are any technical issues. Plans/levels will be posted in the Discord

The weekly post and for SPY 0.00%↑ and QQQ 0.00%↑ was split into two parts, the first without a paywall, and should be reviewed prior to this. Link to Market Analysis for The Week Ahead

Be sure you have read the Trading Doggy Style Starter Kit. I will be adding to this over time, likely first focusing on example executions. Trading Doggy Style Starter Kit.

I’m almost at a loss for words after that. We had expected the market to be supported on dips this week due to passive flows, but that performance following that CPI print was truly inspiring. If this action is confusing or frustrating then it is probably best to avoid trading.

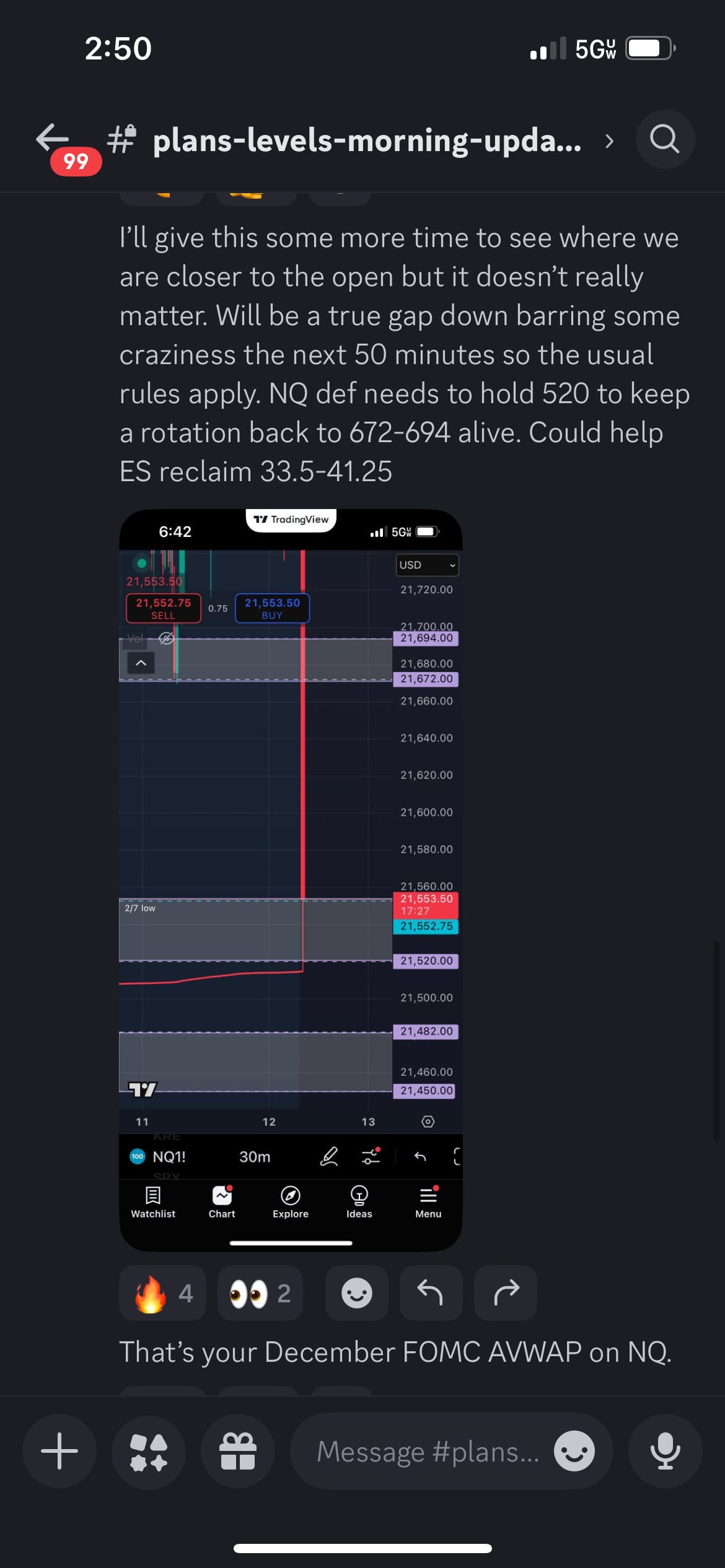

For today we were just focused on the weekly levels. The same thing that had happened repeatedly lately happened again today. A major level was lost (again in news) and bulls simply bid the next level down, and were able to reclaim the prior level. For me today, NQ 21672-21694 was the key battleground. The data candle traded straight through it to the next weekly levels, 21520-21552.75. This corresponded to the December FOMC VWAP and it held.

We can see that sellers made an attempt to defend 672-694 from below but could not make a lower low, giving bulls a chance to reclaim 672-694 which quite clearly they did with nothing but higher highs and higher lows the rest of the day.

This allowed ES to reclaim 6033.5-6041.25, complete its rotation to 6068-6073 and like NQ sellers were unable to make a lower low following the defense.

I had laid out the scenario for a hot CPI today during the weekend. I believe it has major implications but I believe today was peak inflation concerns. I plan to fade this print in my own way. I’ll provide some additional color in tonight’s plan.